Tax Revenue Trends Across Regions

This project explores the dynamics of tax revenue across regions over four decades (1980–2020), leveraging the UNU-WIDER Government Revenue Dataset (GRD). The study focuses on key tax components such as direct taxes, indirect taxes (e.g., VAT), property taxes, and taxes on international trade to provide insights into fiscal policies, revenue mobilization, and regional disparities.

Key Insights and Actionable Takeaways

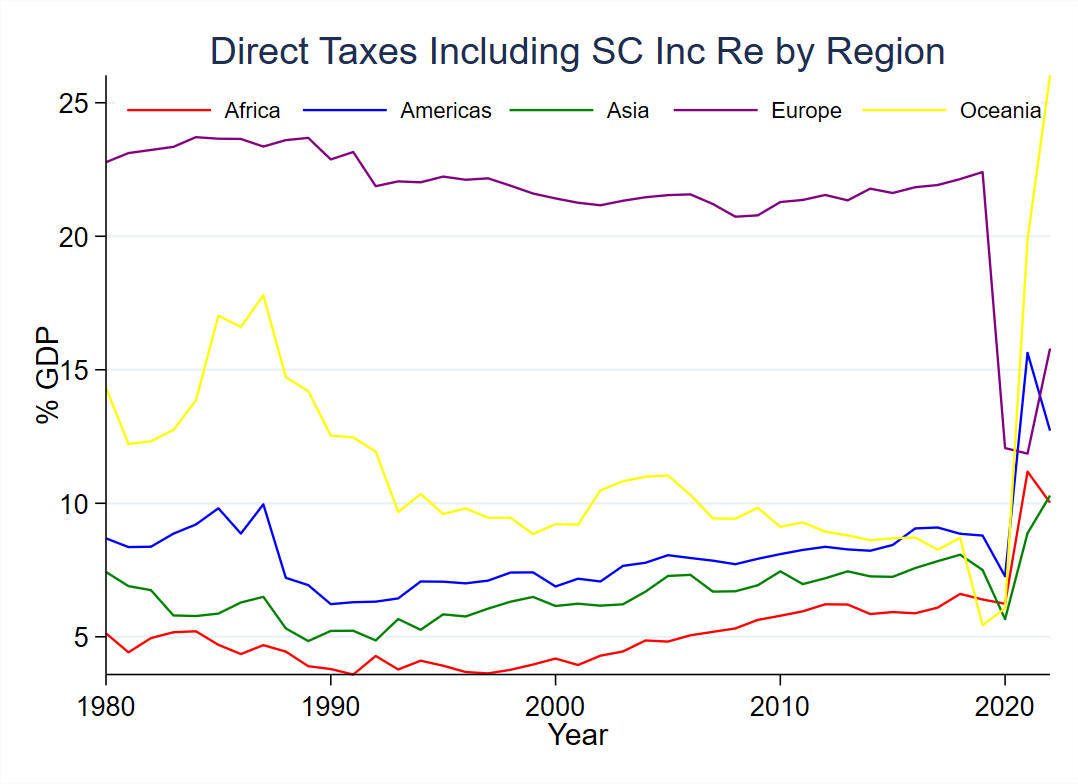

Direct Taxes as a Percentage of GDP

“Europe leads in direct taxes, underscoring advanced tax enforcement systems.”

- Observation: Europe consistently demonstrates the highest reliance on direct taxes as a percentage of GDP, while Africa lags behind. This reflects stronger tax administration and enforcement in Europe.

- Policy Insight: African policymakers should prioritize investments in digital tax systems and implement targeted audits to enhance compliance among high-income earners.

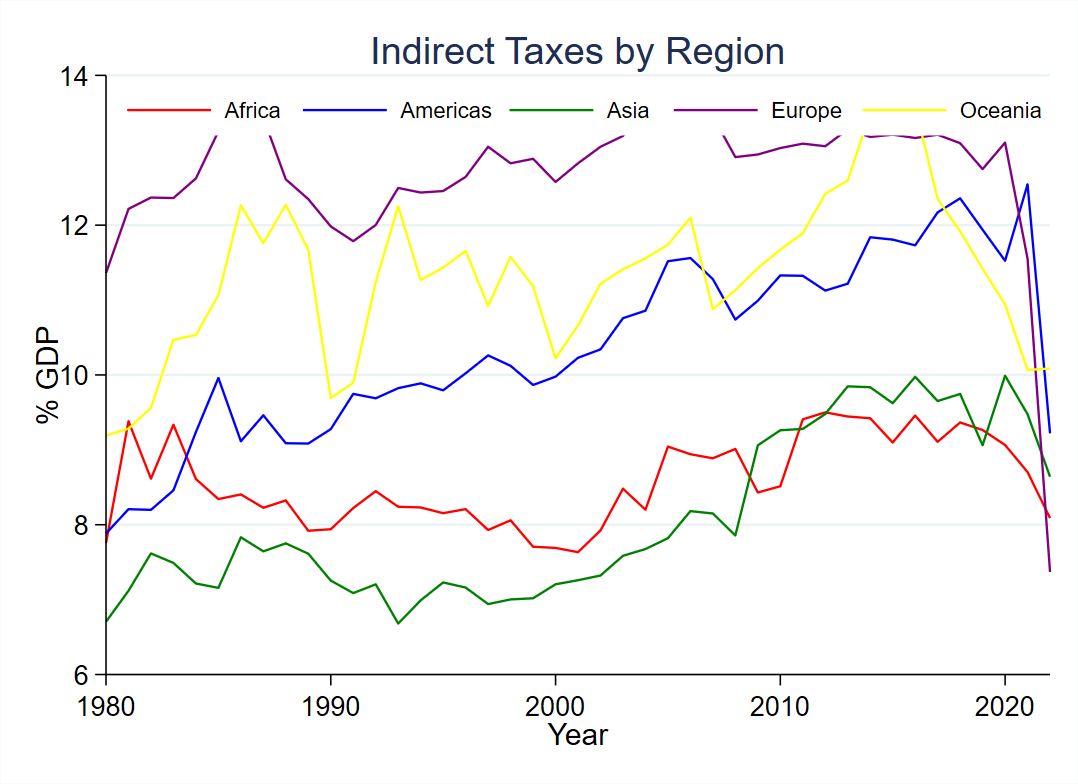

Indirect Taxes (e.g., VAT)

“Indirect taxes are critical revenue sources for Africa and the Americas.”

- Observation: Indirect taxes (e.g., VAT) form the backbone of tax revenue in Africa and the Americas, where enforcement is easier compared to direct taxes. However, this places a disproportionate burden on low-income populations.

- Policy Insight: To ensure equity, governments in these regions should broaden the VAT base while offering exemptions for essential goods and targeted cash transfers to support vulnerable households.

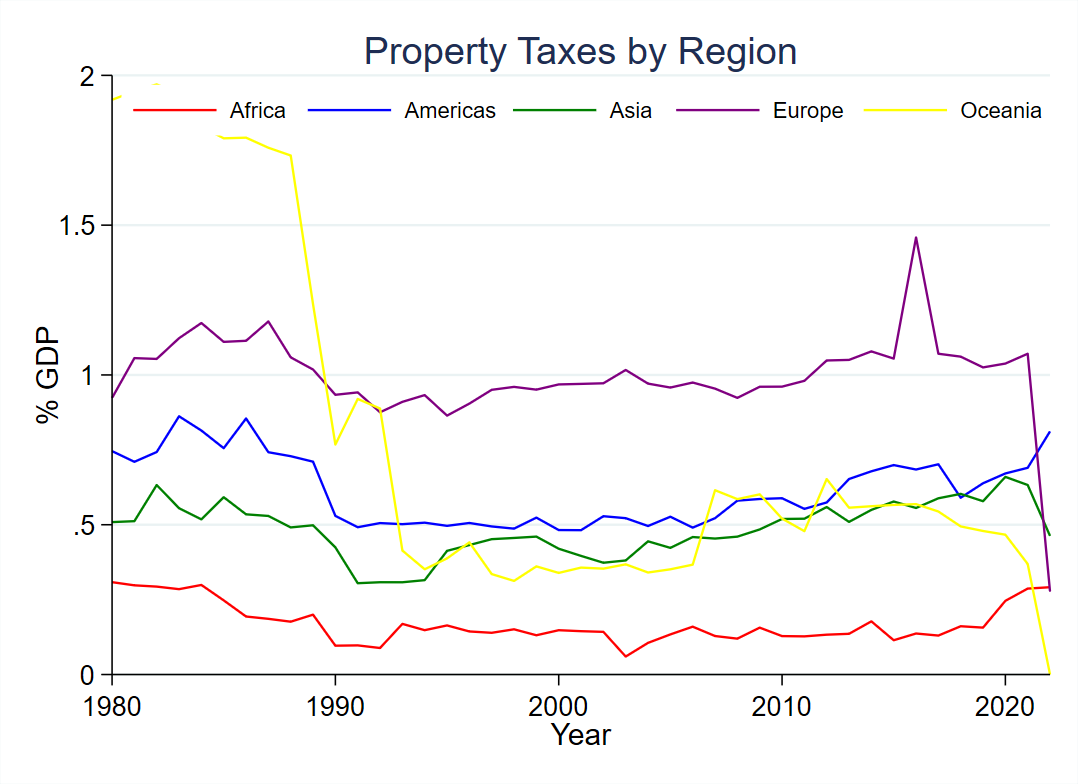

Property Taxes

“Europe’s property tax efficiency highlights the value of institutional reforms.”

- Observation: Property taxes are underutilized globally, contributing less than 1% of GDP in most regions, except in Europe where robust valuation systems exist.

- Policy Insight: Nations in Africa and Asia can improve property tax collection by modernizing land registries and utilizing GIS technology for accurate property valuation.

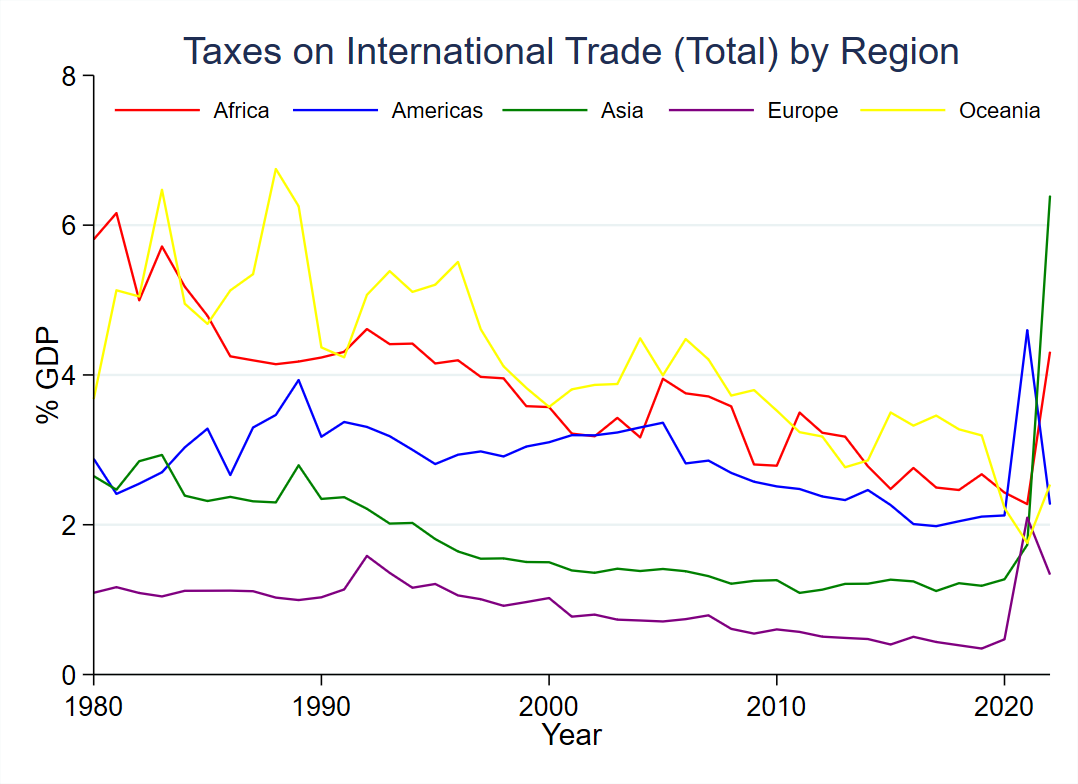

Taxes on International Trade

“Africa’s trade tax reliance reflects the need for fiscal diversification.”

- Observation: Africa relies heavily on trade taxes (e.g., import/export duties) due to weak domestic tax systems, though this reliance has decreased since the 1990s with trade liberalization.

- Policy Insight: Policymakers should diversify revenue streams by strengthening VAT systems and introducing export-friendly policies to boost trade competitiveness.

Relevance for Policymakers and Stakeholders

- Governments: Identify strategies to improve domestic revenue mobilization, especially in low-income regions.

- Development Agencies: Design capacity-building programs for tax administration and compliance.

- Researchers: Utilize these insights to further explore taxation’s role in fiscal policy and economic development.

Why This Matters

This project bridges the gap between data analysis and actionable policy recommendations, providing stakeholders with insights to develop equitable and efficient tax systems tailored to regional needs.