Business Cycle Decomposition of Canadian GDP Using HP Filter

🔍 One of the major goals of modern macroeconomics is to understand how shocks affect the economy and how their effects propagate over time.

But explaining these dynamics remains a challenge—even for experts. As any microeconomist will tell you: sometimes, explaining what an instrumental variable is to a non-economist is harder than the econometrics behind it! 😅

📉 The Reality Behind GDP

GDP doesn’t follow a straight path. It fluctuates, reacts, and deviates—these are business cycles.

Understanding these fluctuations is essential to:

- anticipate crises,

- design effective public policies, and

- guide informed economic decisions.

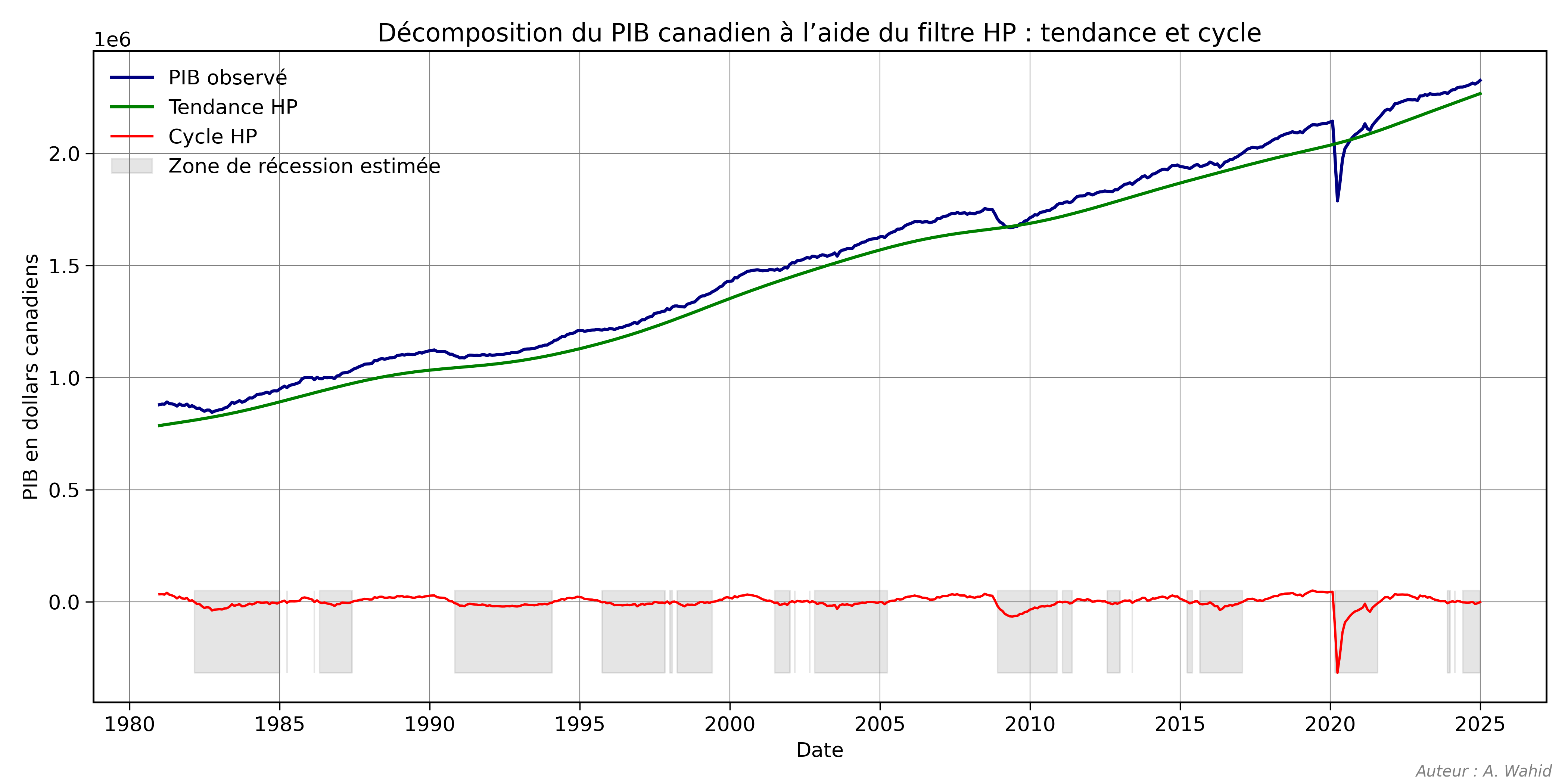

I illustrated this by decomposing Canadian GDP using the Hodrick–Prescott filter, which separates:

- Trend (long-term growth path)

- Cycle (short-term deviations from trend)

📊 Visualization

Legend:

- Blue: Observed GDP

- Green: HP Trend

- Red: HP Cycle

- Gray zones: Estimated recession periods

🧰 Methodology & Data

- Method: Hodrick–Prescott filter (HP Filter)

- Data source: Chaire en macroéconomie et prévisions (CMP), Canada

- Tools used: Python (

pandas,statsmodels,matplotlib)

🧠 Why It Matters

Whether in cooking, medicine, or macroeconomics—precision matters.

- In cooking: a wrong dose can ruin the dish.

- In medicine: a milligram too much can have serious consequences.

- In macroeconomics: misjudging a shock or reacting late can cost thousands of jobs or worsen a recession.

📚 Suggested Readings

- Blanchard, O. (2025) — Convergence? Thoughts about the Evolution of Macroeconomics

- Ramey, V. (2016) — Macroeconomic Shocks and Their Propagation, Handbook of Macroeconomics, Vol. 2, Chap. 2

🏷️ Tags

#Macroeconomics, #HPFilter, #BusinessCycle, #EconomicPolicy, #CanadaGDP, #Python, #TimeSeries, #Blanchard, #Ramey, #NBER